what is fit on a pay stub

In the united states federal income tax is determined by the internal revenue service. Federal Income Tax is withheld from your paycheck based on the amount of income you earn in each pay period.

Free Pay Stub Templates Smartsheet

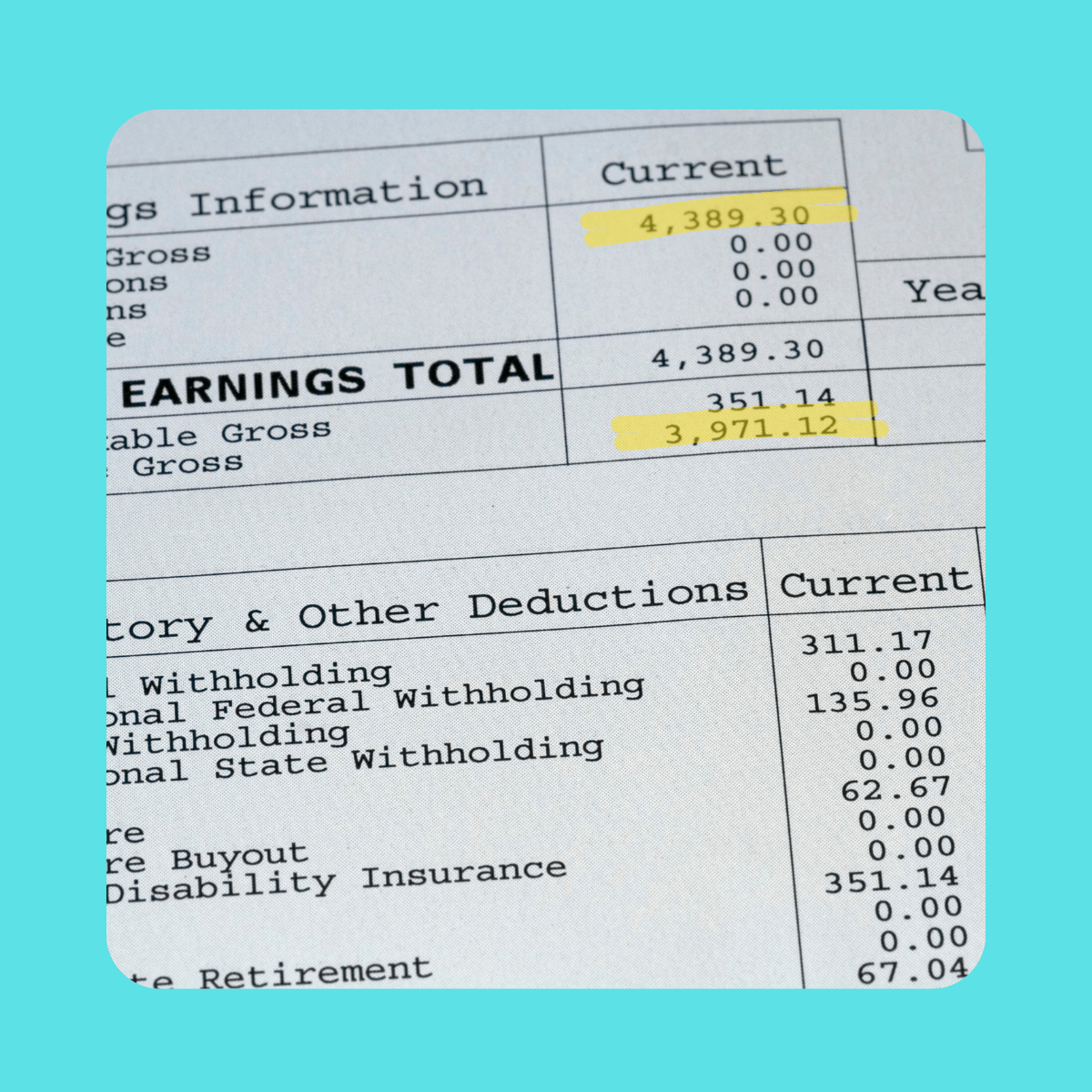

Your net income gets calculated by removing all the deductions.

. State Tax or State Tax Withheld. Add Pay Additional pay. FICA taxes are payroll taxes and they are.

Common Abbreviations Used on Paycheck Stubs. The percentage method is based on the graduated federal tax rates 0 10 12 22 24 32 35 and 37 for individuals. Federal income taxes or FIT is calculated on an employees earnings including regular pay bonuses commissions or other types of taxable earnings.

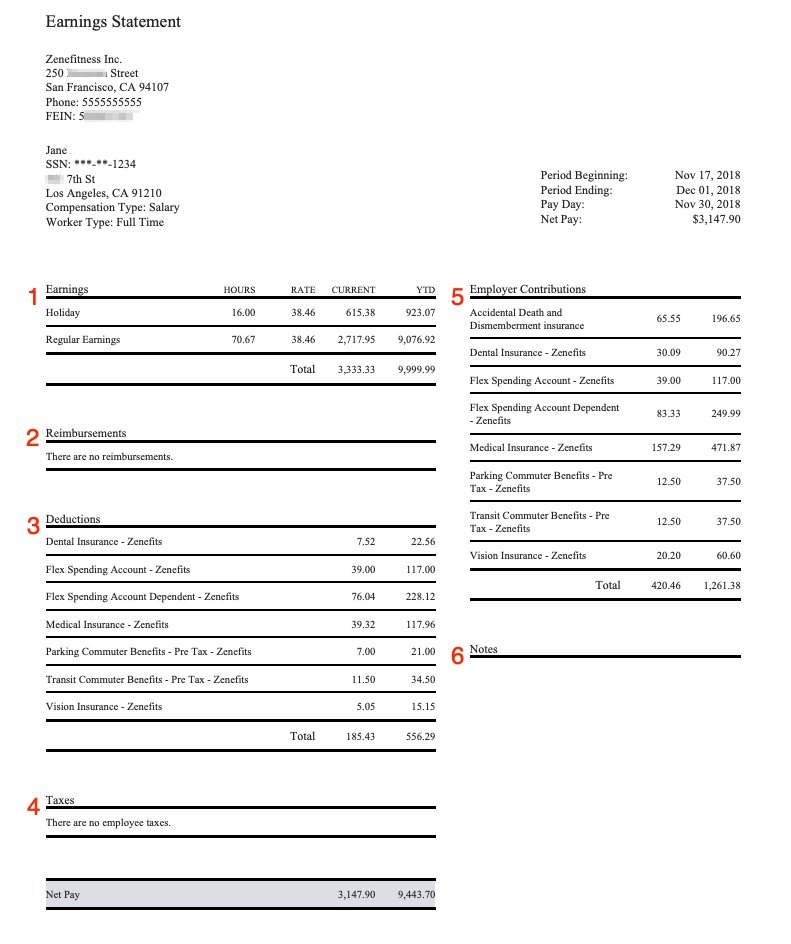

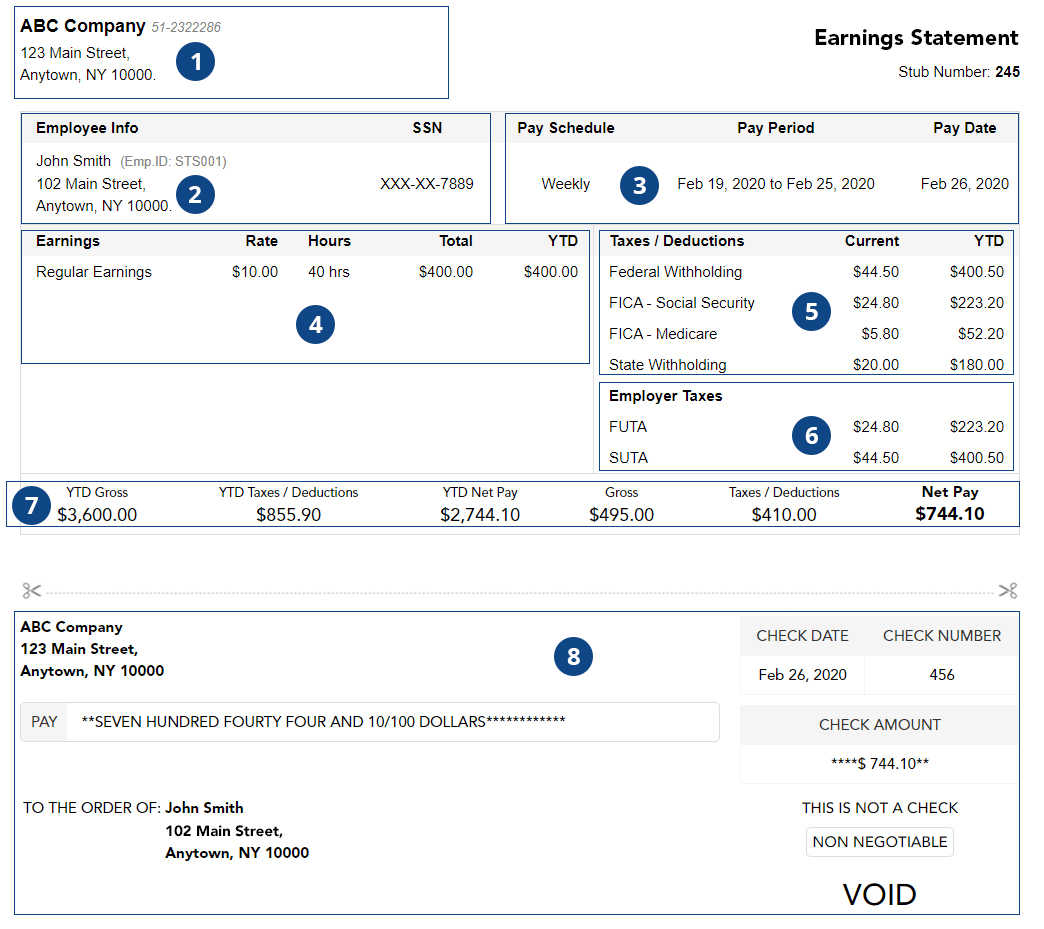

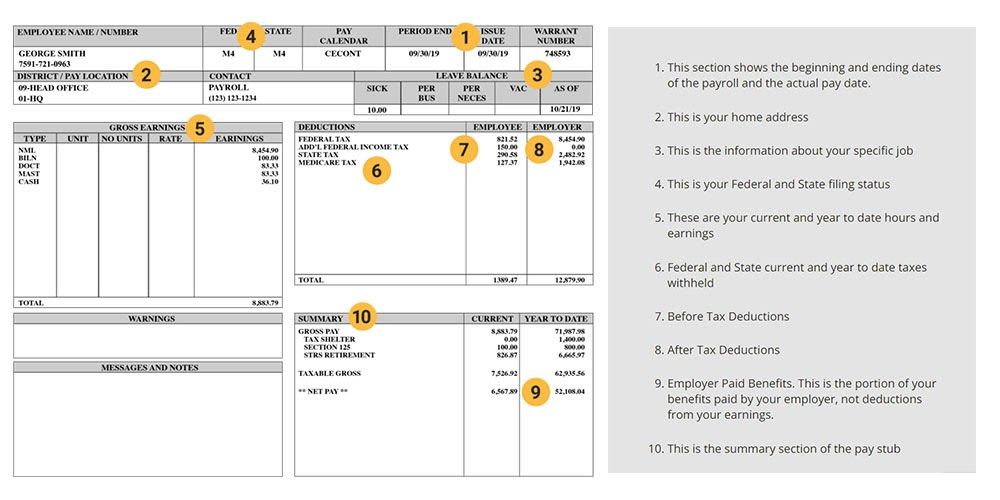

Payroll companies abbreviate the information that is printed on your pay stub to reduce it and make it easier for them to fit a lot of information on a single sheet of paper. Paycheck stubs are normally divided into 4 sections. It itemizes the wages earned for the pay period and year-to-date payroll information.

Fit stands for Federal Income Tax Withheld. TDI probably is some sort of state-level disability insurance payment. Withholding is one way of paying income taxes to the.

FIT Fed Income Tax SIT State Income Tax. What Is Fit On A Pay Stub. How much you can expect to come out of your paycheck in federal income taxes depends on your age filing status and level of income you earn.

The Reason Behind Giving Your Employees Pay Stubs. Knowing what is. Federal Tax or Federal Tax Withheld.

FIT stands for federal income tax. Fit stands for federal income tax. Personal and Check Information.

FIT tax refers to Federal Income Tax. FIT represents the deduction from your gross salary to pay federal withholding also known as income taxesFIT deductions are typically one of the largest deductions on an earnings statement. On every paycheck employers have the obligation to withhold and remit to the government the federal income taxes owed by their employees.

This is known as the FIT tax and it applies to all wages bonuses cash gifts from employers and other forms of compensation. Employers withhold FIT using either a percentage method bracket method or alternative method. BRVMT Bereavement pay.

Pay Stub Abbreviations are the abbreviations that you come across on any pay stub. Pay stubs attest to the fact that both the company and the employee have agreed on a payment system. You will receive a pay stub for each pay period.

Cmp Pyot Compensatory time payout. Pay stubs are created in conjunction with paychecks so each employee gets a new pay stub for each pay period. What companies offer online payroll accounting services.

What Information is Included on a Pay Stub. Below is a sample paycheque and pay stub. Fit FIT.

We Use the Most Recent Information Available You Have Full Confidence in Our Paystubs. Social Security or Social Security Tax Withheld. All individuals and companies who do business in the US.

Op 4 yr. FIT tax is calculated based on an employees Form W-4. Some payroll companies use their own set of these abbreviations while some dont.

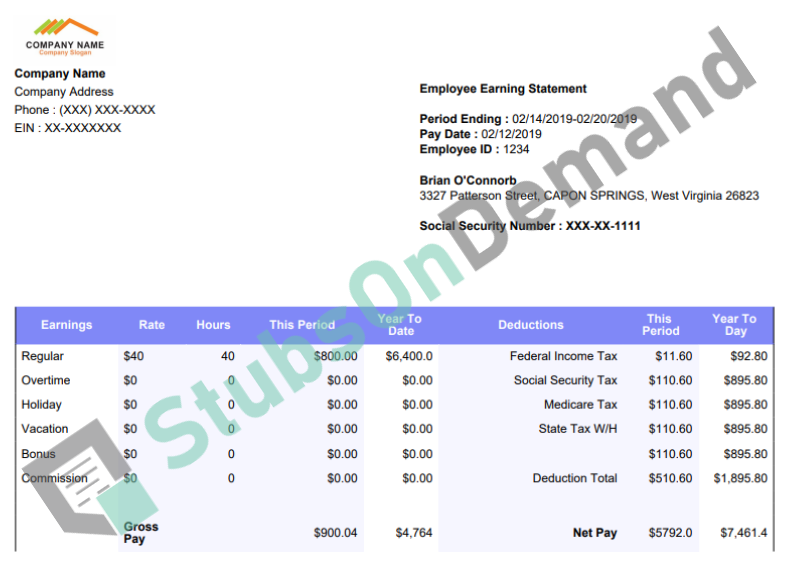

Federal Income Tax. A pay stub also known as a paycheck stub or pay slip is the document that itemizes how much employees are paid. It shows your total earnings for the pay period deductions from the total and your net pay after deductions.

The Federal Income Tax is progressive so the amount will vary based on the projected annual income paid by that employer to you. Answer 1 of 2. CNT Pay Contract pay or your salary Hol Holiday pay.

To use a paycheck calculator program you only need to provide information such as the business name and your salary details. As a business owner you are responsible for withholding the federal income tax from your employees earnings. The taxable wages are likely less than his actual salary because of pre-tax deductions health insurance retirement investments etc which reduce his taxable income.

A pay stub also known as a check stub is the part of a paycheck or a separate document that lists details about the employees pay. Some are income tax withholding. These items go on your income tax return as payments against your income tax liability.

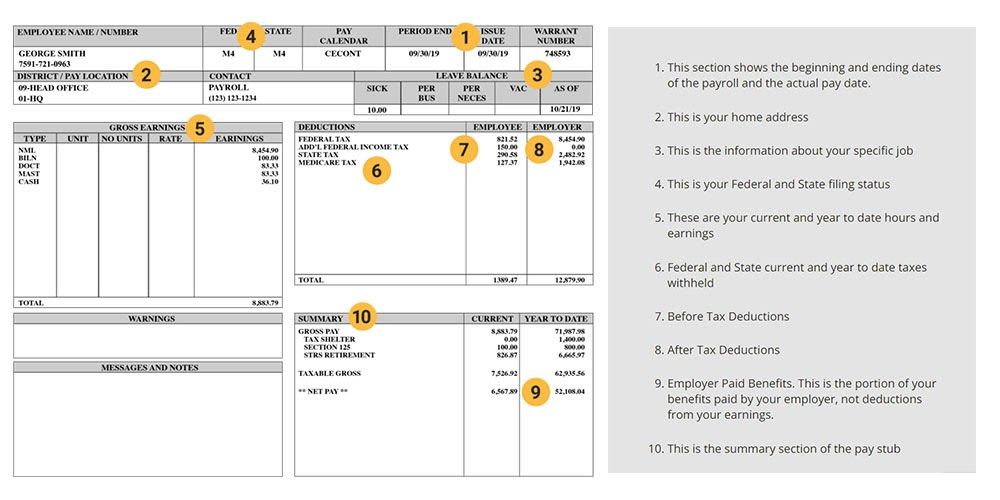

A pay stub also known as a check stub is the part of a paycheck or a separate document that lists details about the employees pay. The employee is responsible for this amount and the FIT tax is. This section shows the beginning and ending dates of the payroll and the actual pay date.

Here is a list of paycheck stub abbreviations that relate to your earnings. FITW is an abbreviation for federal income tax withholding Youll sometimes see it on payroll stubs to identify your withholding deductions. The taxable wages for federal tax for withholding purposes is gotten by taking the gross pay and removing any exclusion that may.

FIT is applied to taxpayers for all of their taxable income during the year. Some entities such as corporations and t. Are subject to certain taxes.

In the United States federal income tax is determined by the Internal Revenue Service. The rate is not the same for every taxpayer. You will pay this tax on all your earnings up to 137700.

FICA would be Social Security and Medicare which are not deductions nor credits on your income tax return. How to Read a Pay Stub An Example Pay Stub. The FIT gross is what I would expect to see in Box 1 of the W-2.

The check stub also shows taxes and other deductions taken out of an employees earnings. It gets removed from your pay added to the Social Security Tax on Medicare Tax Social Security Tax on Wages. Compupay is an online payroll accounting service that.

Ad Generate Your Paystubs Online in a Few Steps and Have Them Emailed to You Right Away. The check stub also shows taxes and other deductions taken out of an employees earnings. This is your home address.

The use of a pay stub generator is easy and takes less than two minutes. This is the information about your specific job.

Free Pay Stub Templates Smartsheet

Free Printable Paycheck Stub Templates Pay Template Canada Inside Free Pay Stub Template Word Cumed Org

Create Pay Stubs Regular Pay Stub Professional Check Stubs Stubcheck Payroll Template Online Checks Regular

A Guide On How To Read Your Pay Stub Accupay Systems

Basic Pay Stub Template Google Docs Google Sheets Excel Word Apple Numbers Apple Pages Pdf Template Net Templates Google Sheets Words

Free Packing Pay Stub Template Excel Word Apple Numbers Apple Pages Pdf Template Net Word Doc Templates Words

Paystub Excel Template The Spreadsheet Page

What Everything On Your Pay Stub Means Money

How To Get A Pay Stub From Direct Deposit By Stubs On Demand Medium

The Ultimate Check Stub Template Monday Com Blog

The Ultimate Check Stub Template Monday Com Blog

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Understanding Your Paycheck Stub Information Earnings Deductions How To Read Your Pay Stub Iris Fmp

What Does A Pay Stub Look Like Workest

Understanding Pay Stub Understanding Paycheck Stub

What Is A Pay Stub Loans Canada

What Is The Ytd Amount On A Pay Stub Quora

:max_bytes(150000):strip_icc()/Paycheck_AdobeStock_154492502_Editorial_Use_Only-b62ac70013ec4e13b3e2a73be5e9c239.jpeg)

Gtl Group Term Life On A Paycheck

What Does Pay Stub Pay Check Stub Salary Slip Or Payslip Mean